Retirement | American Century

4.11.1921 by American Century Investments, Inc. (0 Reviews) September 14, 2024Latest Version

Version

4.11.1921

4.11.1921

Update

September 14, 2024

September 14, 2024

Developer

American Century Investments, Inc.

American Century Investments, Inc.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.americancentury.wpr

com.americancentury.wpr

Report

Report a Problem

Report a Problem

More About Retirement | American Century

Investing for retirement is one of the most important things you’ll do, so it’s important to stay in tune with your progress. Knowing the status of your employer’s retirement plan investments can help you determine what steps to take next. The American Century Investments® Workplace app is an extension of our commitment to help you achieve the kind of retirement you want and to keep you connected to your goal. For over 60 years we’ve been helping people through a steadfast approach to managing money and personal service.

The app works with IOS operating system 15 or newer. Features are available for workplace retirement plan investors only. Personal mutual fund accounts can be tracked on the American Century Investments Invest app.

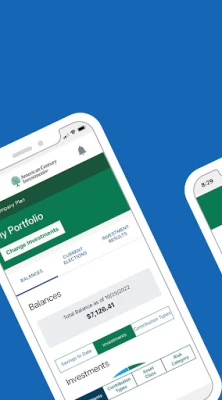

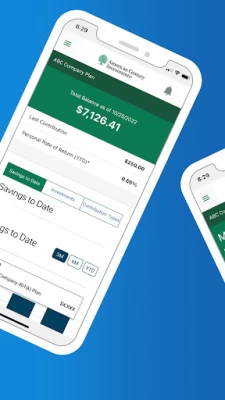

View Key Details About Your Retirement Account

The information you want—from how much you have, to how your investments are performing—is available any time.

•Check balances on the go for each investment choice and contribution type.

•Track the progress of your personal rate of return--it can help you make decisions on what to do next.

•Stay on top of your account by reviewing transaction history, outstanding loans (if offered) and recent withdrawals. You can also check future contributions and how they will be allocated among your investment selections.

Make Changes to Your Account

When you need to adjust something on your account, the app makes it easy to do from wherever you are.

•Exchange shares or money between funds you own

•Rebalance your account if market activity has caused your allocations to be different than the original ones you chose.

•Adjust how future contributions are allocated (divided) among your fund choices if you decide you need a change.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

View Key Details About Your Retirement Account

The information you want—from how much you have, to how your investments are performing—is available any time.

•Check balances on the go for each investment choice and contribution type.

•Track the progress of your personal rate of return--it can help you make decisions on what to do next.

•Stay on top of your account by reviewing transaction history, outstanding loans (if offered) and recent withdrawals. You can also check future contributions and how they will be allocated among your investment selections.

Make Changes to Your Account

When you need to adjust something on your account, the app makes it easy to do from wherever you are.

•Exchange shares or money between funds you own

•Rebalance your account if market activity has caused your allocations to be different than the original ones you chose.

•Adjust how future contributions are allocated (divided) among your fund choices if you decide you need a change.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.